One Ecosystem. Three Roles

Investment Thesis

Most crypto projects fail because they are passive.

Liquidity is seeded once. Supply is released without discipline.

The market is expected to behave.

The House of Cauliman is actively managed.

This ecosystem is designed for durability, not short-term attention cycles.

If usage grows, the structure strengthens.

The Filter

Trust and verification layer.

Highlights builders, exposes bad actors, filters noise.

Fixed supply • Usage-driven relevance • Value accrues through verification demand

The Engine

Captures participation, games, and culture.

Routes activity through on-chain mechanics.

Arcade systems • High engagement • Utility-driven demand

The IP

Digital property — characters, operators, artifacts.

Tied to a growing interactive universe.

Collectible scarcity • Game-aligned demand • Long-term IP expansion

Sit above tokens. Individually illustrated access instruments and cultural assets.

Finite • No inflation • Ownership-based access

Unlock early access, private channels, priority participation, future permissions.

As the ecosystem grows, access becomes scarcer and more valuable.

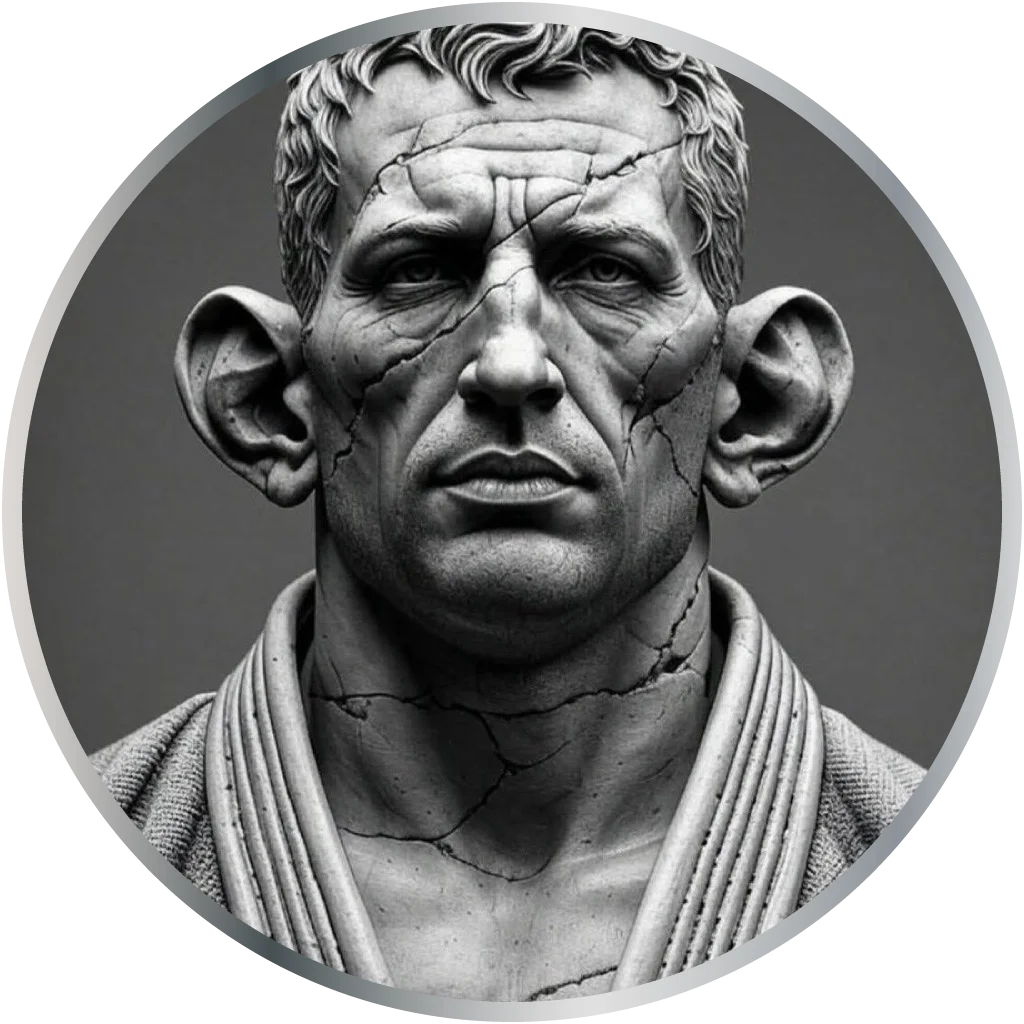

Example: Power Punks — Exaggerated power. Loud identity. Built to stand out on the ledger.

The House is built on XRPL for one reason: structural efficiency.

Low fees enable high-frequency interaction.

Fast finality allows real-time systems.

Native DEX and AMM mechanics remove dependency on third parties.

This ecosystem does not survive despite the chain.

It survives because of it.

Participation enters through culture and access.

Engagement routes through games, verification, and IP.

Value consolidates back into managed liquidity.

Tokens do not exist in isolation.

They function as routing instruments inside a closed economic loop.

Usage feeds liquidity.

Liquidity supports the floor.

The floor enables long-term participation.

This ecosystem is not unmanaged.

Decisions are intentional, not crowdsourced.

Supply pacing, liquidity actions, and expansion timing are handled by the House.

The objective is stability first, growth second.

Chaos is not decentralization.

Structure is.

This is not a launch-and-exit system.

Floors are built slowly.

Access compounds over time.

Early participation is rewarded through position, not promises.

If you need fast liquidity, this is not designed for you.

Liquidity seeded, retained, and reinforced by the House.

No external entity can remove the base.

Reseeding: As usage increases, liquidity reintroduced → floor steps upward.

Timed releases: Supply aligned with real demand absorption.

Price may fluctuate. The base remains intact.

Patience structurally favored.

Participation aligns with growth.

Time strengthens positioning.

Digital assets carry volatility, execution risk, and regulatory uncertainty.

Outcomes depend on continued development, adoption, and market conditions.

No returns are promised. No timelines are guaranteed.

This thesis describes structure, not certainty.